Long Term Disability Insurance: Long-Term Financial Aid for Sick & Injured Workers

Our Long Term Disability Insurance practice focuses on helping people with their long term disability insurance disputes. Many people are confused about what long term disability insurance is, who is eligible to receive it, and how it differs from other disability benefits, such as Social Security Disability Insurance (SSDI).

To start, long term disability insurance is a private insurance policy that provides replacement income if you cannot perform the duties of your job. You can purchase a long term disability insurance policy from an insurance agent or your employer may offer this as a part of your benefits package. This is distinct from governmental benefits, such as SSDI. Long term disability insurance also is different from disability benefits that may be available through your employer’s pension plan.

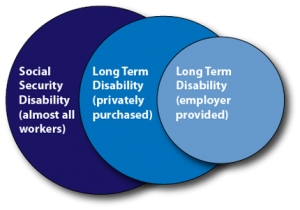

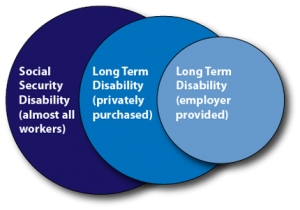

You may have one or more of the three types of disability-related insurance.

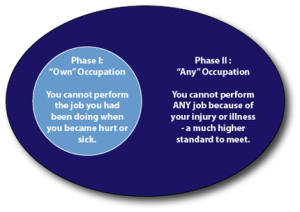

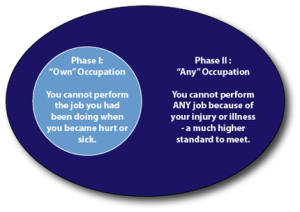

Each long term disability insurance policy is different, but most policies contain similar provisions. For example, most long term disability insurance policies provide that if you become disabled, you will receive a percentage of your pre-disability wages. Most policies also define disability in two stages. The first stage provides benefits if you cannot perform the duties of your specific profession (the “own occupation period”). The second stage provides benefits if you cannot perform the duties of any occupation for which you are qualified (the “any occupation period”). Long term disability insurance policies generally provide that your disability benefits will be reduced by any other benefits you are receiving, such as SSDI or workers compensation benefits. Finally, most policies distinguish between physical disabilities and mental disabilities.

Disability is typically defined in two phases: “own” vs. “any” occupation.

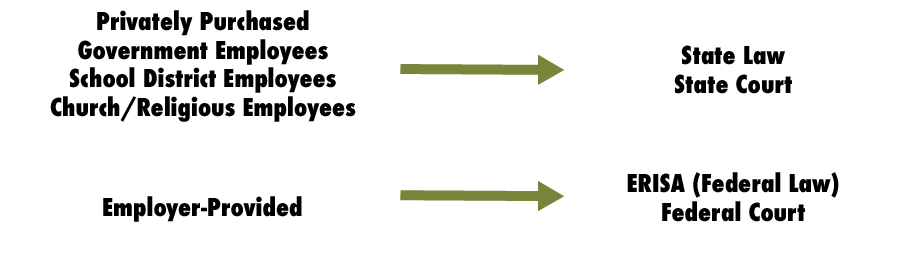

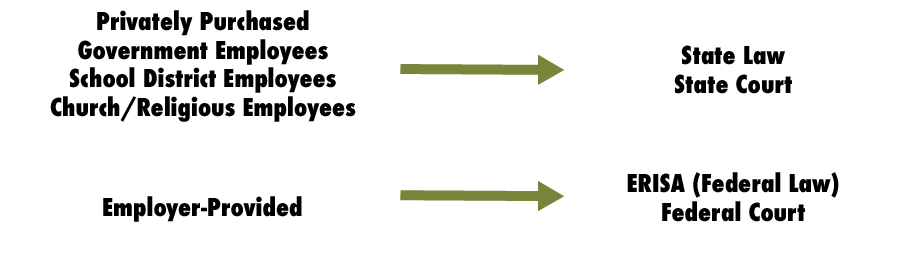

It is also important to know what set of laws will govern your long term disability insurance policy. If your policy comes from your employer, your policy likely will be governed by a federal law known as the Employee Retirement Income Security Act of 1974 (ERISA). This is generally the case, unless you work for the government, including a school district or a religious organization. If you work for the government or you purchase your policy separately, your policy will likely be governed by the laws of the state you live in. This distinction matters when you try to enforce your right to long term disability insurance.

Some LTDI insurance is governed by state law, while federal law governs others.

Making a Long Term Disability Claim

If you suffer from a medical condition that prevents you from working and you expect the condition to last for some time, you generally can file a long term disability insurance claim. The process involves three main elements:

1. You must file paperwork explaining why your condition prevents you from working.

2. Your doctor must certify you are unable to perform the duties of your job.

3. Finally, your employer will need to file paperwork describing your job duties.

Once the long term disability insurance company receives all of this information, it will review your claim. This process generally takes between two to six weeks, depending on the complexity of your claim.

What Happens if My Long Term Disability Insurance Claim Is Approved?

If the insurance company agrees you meet its definition of disability, you will start receiving your long term disability benefits, subject to any waiting period contained in your plan. These benefits may be considered taxable income, depending on how the premiums were paid. If you paid for the premium with after-tax dollars, your long term disability insurance benefits will not be taxable. If your employer paid the premium or if you paid for the premium with before-tax dollars, then your benefits will be taxed as if it were ordinary income.

Once your claim is approved, the insurance company typically requires you to apply for other benefits (e.g. SSDI benefits) you may be entitled to. You must update the insurance company about your ongoing medical condition and any changes to your health. From time to time, the insurance company will review your file to make sure you remain disabled. If your policy divides your disability period into two stages, the insurance company will definitely review your claim if the disability definition changes from “own occupation” to “any occupation.”

What Happens if My Long Term Disability Insurance Claim Is Denied?

This is where Hawks Quindel can help you. Long term disability insurance companies are running a business; like any business, they want to maximize their profits. To do so, they deny many valid long term disability claims and hope these individuals will not pursue their claims any further. Insurance companies retain doctors who they pay to give an opinion saying you are not disabled. Insurance companies will often hire private investigators to conduct surveillance and twist these videos to say you are capable of working.

If your claim is denied, you will need to appeal this denial. The deadline to appeal will be stated in the denial letter. Often, you will have only 180 days to appeal – but under some circumstances, you may have even less time than that.

Appealing a Denied Long Term Disability Insurance Claim

Filing a long term disability appeal involves three main components: (1) informing the insurance company you are appealing the denial, (2) disputing the basis for the denial, and (3) submitting all supporting evidence. The most persuasive evidence to the disability insurance company is objective personal testimony from you and people who have witnessed your disability. Reports from your treating doctors, medical questionnaires, and test results are also very helpful. Beyond this, you may want to use a functional capacity evaluation or a vocational expert to dispute the findings of the insurance company. If the insurance company’s denial violates the law, it is helpful to provide legal citations documenting its illegal activities.

After your appeal is submitted, the insurance company will have 45 days to make a decision. The insurance company can also request up to an additional 45 days if it wants to gather more information. In most cases, you will receive a decision regarding your appeal about 90 days after the appeal is filed. If your appeal is approved, your benefits will be reinstated. If the denial is upheld, then depending on the terms of the plan, you may have the right to a second (or third) appeal, or your file may be closed. If your file is closed, your next move is to file a lawsuit.

* Note: If your claim is governed by ERISA, the appeal period may be your one and only opportunity to supplement the record and stand up for yourself. It is critical to gather thorough evidence here in case the dispute goes to court later on.

Filing a Long Term Disability Insurance Lawsuit

Even if your appeal is denied, you still have the right to sue the insurance company to restore your benefits. Your potential damages are determined by:

1. The type of long term disability insurance policy you have

2. The court that will have jurisdiction over your claim

If your claim is not governed by ERISA, you will be able to sue for benefit reinstatement, retroactive benefits, and possibly attorney fees, bad faith damages, interest, and compensatory damages (varies by state). These types of cases will be brought in state court and will be subject to your state’s insurance laws. For a non-ERISA based lawsuit, you may present supplemental evidence, including expert witnesses, medical testimony, additional documents, and your own testimony. All of this can be used to persuade the judge and jury that you are entitled to long term disability insurance.

If your claim is governed by ERISA, however, you may only sue for reinstatement of benefits, retroactive benefits, and attorney fees (if the court approves). There are no punitive or compensatory damages available in an ERISA-based long term disability insurance lawsuit. This is unfortunate because insurance companies take advantage of these rules and are emboldened to deny many valid claims, knowing that at worst, they will simply have to pay the benefits owed and potentially some attorney fees. The insurance company has other advantages in ERISA-based long term disability insurance lawsuits. For example:

1. You do not have a right to a jury trial. The case will be decided by a single judge.

2. There is no opportunity to supplement the record after the close of the appeal process. This means your case is limited to the recorded evidence as of the time the insurance company denied your final appeal.

3. There will not be a trial and the judge never meets you or hears from any witnesses.

Finally, the biggest advantage insurance companies have is they need not prove you are not entitled to long term disability insurance benefits. Rather, you must prove the insurance company acted unreasonably in denying your claim. This means even if the judge disagrees with the insurance company’s decision, it will still uphold the denial unless you can prove it was unreasonable for the insurance company to come to its conclusion.

These are some big advantages in favor of the insurance company, but they can be overcome with skilled legal representation.

Why Hire a Long Term Disability Insurance Attorney?

Working with an experienced long term disability insurance attorney can help swing the odds in your favor. Insurance companies deny claims all the time, so you want to make sure you are working with someone who knows their tactics and can put you in the best position to get your benefits back. If you choose not to work with an attorney, you risk failing to create a strong record of evidence to support your claim or failing to address key legal arguments. For example, it is important to start building the evidence for your claim as soon as possible. A good long term disability attorney will know what evidence is important, where it should come from, and how to obtain the evidence you need to win your case. Beyond this, an experienced long term disability attorney will know when an insurance company has violated the law and how to make the critical legal arguments necessary to persuade a judge or jury to reinstate your benefits.

When Should You Contact a Long Term Disability Attorney?

If your claim is denied or if you believe it will be denied, you should contact a long term disability insurance attorney as soon as possible. The timeframe for appealing a long term disability insurance denial is very short. It is beneficial for you to have as much time as possible to gather the evidence needed to reinstate your benefits. You can also hire an attorney after your appeal has been denied; though you have fewer options at this point, an attorney’s skills will be even more critical if you think you have been denied your rights unfairly.

What to Look For in a Long Term Disability Attorney

Finding an experienced long term disability insurance attorney will give you the best chance to reinstate your benefits. When looking for an attorney to represent you:

1. Ask for references from current and former clients.

2. Read the attorney’s website to make sure he or she has significant experience representing individuals with long term disability claims and has a track record for success.

3. A reputable long term disability insurance attorney should offer to review your denial letter and medical records for no charge before meeting with you to discuss your case.

4. Finally, your long term disability insurance attorney should be willing to work on a contingent fee basis. This means that your attorney will not get a fee unless you receive benefits. If the attorney is not willing to work on a contingent fee basis, it likely means he does not think he can secure benefits for you or he is looking after his interests more than yours.

Our practice focuses on helping people get their long term disability benefits. We have been fighting for disabled people for years and have secured benefits for our clients from all of the major long term disability insurance companies, including Unum, CIGNA, Hartford, MetLife, Sun Life, Lincoln Financial, Mutual of Omaha, Disability RMS, Reliant Standard, Northwestern Mutual Life, and Madison National Life.

It may seem daunting to challenge a large, established insurance company that seems determined to deny your benefits, but the intimidation is 90% of their game. It does not matter how big they are, all that matters are the facts of your case and the evidence we can show to support those facts. If you are sick or injured, we will mount a formidable response to your benefits denial and give you a good opportunity to secure your benefits.

Contact Us For a Free Consultation

If you are unable to perform the duties of your job due to a sickness or injury and have been denied disability benefits, or if you would like to learn more about disability benefits claims, the lawyers at Hawks Quindel are here to help. Please contact us for a free consultation to discuss your rights regarding short term disability benefits or long term disability benefits. We represent individuals throughout Wisconsin on a contingent fee basis.

Contact us if you would like to discuss your situation or legal rights with a Wisconsin disability attorney. Please call a Madison disability attorney directly at (608) 257-0040 or a Milwaukee disability attorney at (414) 271-8650, or email us via our Contact Page.

To learn more about our Long Term Disability practice, please see our Long Term Disability blog topics.

Long Term Disability Insurance: Long-Term Financial Aid for Sick & Injured Workers

Our Long Term Disability Insurance practice focuses on helping people with their long term disability insurance disputes. Many people are confused about what long term disability insurance is, who is eligible to receive it, and how it differs from other disability benefits, such as Social Security Disability Insurance (SSDI).

To start, long term disability insurance is a private insurance policy that provides replacement income if you cannot perform the duties of your job. You can purchase a long term disability insurance policy from an insurance agent or your employer may offer this as a part of your benefits package. This is distinct from governmental benefits, such as SSDI. Long term disability insurance also is different from disability benefits that may be available through your employer’s pension plan.

You may have one or more of the three types of disability-related insurance.

Each long term disability insurance policy is different, but most policies contain similar provisions. For example, most long term disability insurance policies provide that if you become disabled, you will receive a percentage of your pre-disability wages. Most policies also define disability in two stages. The first stage provides benefits if you cannot perform the duties of your specific profession (the “own occupation period”). The second stage provides benefits if you cannot perform the duties of any occupation for which you are qualified (the “any occupation period”). Long term disability insurance policies generally provide that your disability benefits will be reduced by any other benefits you are receiving, such as SSDI or workers compensation benefits. Finally, most policies distinguish between physical disabilities and mental disabilities.

Disability is typically defined in two phases: “own” vs. “any” occupation.

It is also important to know what set of laws will govern your long term disability insurance policy. If your policy comes from your employer, your policy likely will be governed by a federal law known as the Employee Retirement Income Security Act of 1974 (ERISA). This is generally the case, unless you work for the government, including a school district or a religious organization. If you work for the government or you purchase your policy separately, your policy will likely be governed by the laws of the state you live in. This distinction matters when you try to enforce your right to long term disability insurance.

Some LTDI insurance is governed by state law, while federal law governs others.

Making a Long Term Disability Claim

If you suffer from a medical condition that prevents you from working and you expect the condition to last for some time, you generally can file a long term disability insurance claim. The process involves three main elements:

1. You must file paperwork explaining why your condition prevents you from working.

2. Your doctor must certify you are unable to perform the duties of your job.

3. Finally, your employer will need to file paperwork describing your job duties.

Once the long term disability insurance company receives all of this information, it will review your claim. This process generally takes between two to six weeks, depending on the complexity of your claim.

What Happens if My Long Term Disability Insurance Claim Is Approved?

If the insurance company agrees you meet its definition of disability, you will start receiving your long term disability benefits, subject to any waiting period contained in your plan. These benefits may be considered taxable income, depending on how the premiums were paid. If you paid for the premium with after-tax dollars, your long term disability insurance benefits will not be taxable. If your employer paid the premium or if you paid for the premium with before-tax dollars, then your benefits will be taxed as if it were ordinary income.

Once your claim is approved, the insurance company typically requires you to apply for other benefits (e.g. SSDI benefits) you may be entitled to. You must update the insurance company about your ongoing medical condition and any changes to your health. From time to time, the insurance company will review your file to make sure you remain disabled. If your policy divides your disability period into two stages, the insurance company will definitely review your claim if the disability definition changes from “own occupation” to “any occupation.”

What Happens if My Long Term Disability Insurance Claim Is Denied?

This is where Hawks Quindel can help you. Long term disability insurance companies are running a business; like any business, they want to maximize their profits. To do so, they deny many valid long term disability claims and hope these individuals will not pursue their claims any further. Insurance companies retain doctors who they pay to give an opinion saying you are not disabled. Insurance companies will often hire private investigators to conduct surveillance and twist these videos to say you are capable of working.

If your claim is denied, you will need to appeal this denial. The deadline to appeal will be stated in the denial letter. Often, you will have only 180 days to appeal – but under some circumstances, you may have even less time than that.

Appealing a Denied Long Term Disability Insurance Claim

Filing a long term disability appeal involves three main components: (1) informing the insurance company you are appealing the denial, (2) disputing the basis for the denial, and (3) submitting all supporting evidence. The most persuasive evidence to the disability insurance company is objective personal testimony from you and people who have witnessed your disability. Reports from your treating doctors, medical questionnaires, and test results are also very helpful. Beyond this, you may want to use a functional capacity evaluation or a vocational expert to dispute the findings of the insurance company. If the insurance company’s denial violates the law, it is helpful to provide legal citations documenting its illegal activities.

After your appeal is submitted, the insurance company will have 45 days to make a decision. The insurance company can also request up to an additional 45 days if it wants to gather more information. In most cases, you will receive a decision regarding your appeal about 90 days after the appeal is filed. If your appeal is approved, your benefits will be reinstated. If the denial is upheld, then depending on the terms of the plan, you may have the right to a second (or third) appeal, or your file may be closed. If your file is closed, your next move is to file a lawsuit.

* Note: If your claim is governed by ERISA, the appeal period may be your one and only opportunity to supplement the record and stand up for yourself. It is critical to gather thorough evidence here in case the dispute goes to court later on.

Filing a Long Term Disability Insurance Lawsuit

Even if your appeal is denied, you still have the right to sue the insurance company to restore your benefits. Your potential damages are determined by:

1. The type of long term disability insurance policy you have

2. The court that will have jurisdiction over your claim

If your claim is not governed by ERISA, you will be able to sue for benefit reinstatement, retroactive benefits, and possibly attorney fees, bad faith damages, interest, and compensatory damages (varies by state). These types of cases will be brought in state court and will be subject to your state’s insurance laws. For a non-ERISA based lawsuit, you may present supplemental evidence, including expert witnesses, medical testimony, additional documents, and your own testimony. All of this can be used to persuade the judge and jury that you are entitled to long term disability insurance.

If your claim is governed by ERISA, however, you may only sue for reinstatement of benefits, retroactive benefits, and attorney fees (if the court approves). There are no punitive or compensatory damages available in an ERISA-based long term disability insurance lawsuit. This is unfortunate because insurance companies take advantage of these rules and are emboldened to deny many valid claims, knowing that at worst, they will simply have to pay the benefits owed and potentially some attorney fees. The insurance company has other advantages in ERISA-based long term disability insurance lawsuits. For example:

1. You do not have a right to a jury trial. The case will be decided by a single judge.

2. There is no opportunity to supplement the record after the close of the appeal process. This means your case is limited to the recorded evidence as of the time the insurance company denied your final appeal.

3. There will not be a trial and the judge never meets you or hears from any witnesses.

Finally, the biggest advantage insurance companies have is they need not prove you are not entitled to long term disability insurance benefits. Rather, you must prove the insurance company acted unreasonably in denying your claim. This means even if the judge disagrees with the insurance company’s decision, it will still uphold the denial unless you can prove it was unreasonable for the insurance company to come to its conclusion.

These are some big advantages in favor of the insurance company, but they can be overcome with skilled legal representation.

Why Hire a Long Term Disability Insurance Attorney?

Working with an experienced long term disability insurance attorney can help swing the odds in your favor. Insurance companies deny claims all the time, so you want to make sure you are working with someone who knows their tactics and can put you in the best position to get your benefits back. If you choose not to work with an attorney, you risk failing to create a strong record of evidence to support your claim or failing to address key legal arguments. For example, it is important to start building the evidence for your claim as soon as possible. A good long term disability attorney will know what evidence is important, where it should come from, and how to obtain the evidence you need to win your case. Beyond this, an experienced long term disability attorney will know when an insurance company has violated the law and how to make the critical legal arguments necessary to persuade a judge or jury to reinstate your benefits.

When Should You Contact a Long Term Disability Attorney?

If your claim is denied or if you believe it will be denied, you should contact a long term disability insurance attorney as soon as possible. The timeframe for appealing a long term disability insurance denial is very short. It is beneficial for you to have as much time as possible to gather the evidence needed to reinstate your benefits. You can also hire an attorney after your appeal has been denied; though you have fewer options at this point, an attorney’s skills will be even more critical if you think you have been denied your rights unfairly.

What to Look For in a Long Term Disability Attorney

Finding an experienced long term disability insurance attorney will give you the best chance to reinstate your benefits. When looking for an attorney to represent you:

1. Ask for references from current and former clients.

2. Read the attorney’s website to make sure he or she has significant experience representing individuals with long term disability claims and has a track record for success.

3. A reputable long term disability insurance attorney should offer to review your denial letter and medical records for no charge before meeting with you to discuss your case.

4. Finally, your long term disability insurance attorney should be willing to work on a contingent fee basis. This means that your attorney will not get a fee unless you receive benefits. If the attorney is not willing to work on a contingent fee basis, it likely means he does not think he can secure benefits for you or he is looking after his interests more than yours.

Our practice focuses on helping people get their long term disability benefits. We have been fighting for disabled people for years and have secured benefits for our clients from all of the major long term disability insurance companies, including Unum, CIGNA, Hartford, MetLife, Sun Life, Lincoln Financial, Mutual of Omaha, Disability RMS, Reliant Standard, Northwestern Mutual Life, and Madison National Life.

It may seem daunting to challenge a large, established insurance company that seems determined to deny your benefits, but the intimidation is 90% of their game. It does not matter how big they are, all that matters are the facts of your case and the evidence we can show to support those facts. If you are sick or injured, we will mount a formidable response to your benefits denial and give you a good opportunity to secure your benefits.

Contact Us For a Free Consultation

If you are unable to perform the duties of your job due to a sickness or injury and have been denied disability benefits, or if you would like to learn more about disability benefits claims, the lawyers at Hawks Quindel are here to help. Please contact us for a free consultation to discuss your rights regarding short term disability benefits or long term disability benefits. We represent individuals throughout Wisconsin on a contingent fee basis.

Contact us if you would like to discuss your situation or legal rights with a Wisconsin disability attorney. Please call a Madison disability attorney directly at (608) 257-0040 or a Milwaukee disability attorney at (414) 271-8650, or email us via our Contact Page.

To learn more about our Long Term Disability practice, please see our Long Term Disability blog topics.

Tell us Your Story.

We’ll Tell you If We Can Help.