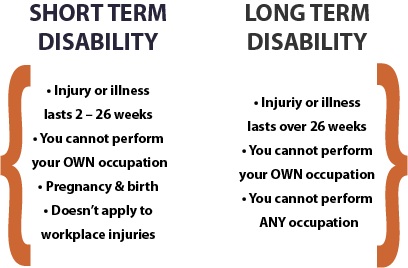

Short term and long term disability insurance provide replacement income if you are unable to continue working due to an illness or accident. As the name implies, short term disability insurance provides replacement income for shorter periods of time when you cannot work. Short term disability also covers time off due to pregnancy and child birth. If your medical condition keeps you from returning to work after the short term disability period ends, then you can transition to long term disability insurance benefits. In other words, when your short term disability insurance benefits end, your long term disability insurance benefits begin.

Key Distinctions Between Short Term and Long Term Disability Insurance

Short term disability insurance provides income replacement if you are unable to perform the duties of your occupation for a short period of time. Long term disability insurance provides continued benefits if the illness or injury keeps you out of work for a longer period of time. Aside from this rather obvious difference, there are a few other differences you should be aware of.

First, short term disability insurance benefits can end if you lose your employment while disabled. This means if you become unable to continue working due to a disability and you lose your job because your employer refuses to hold your job for you, your short term disability benefits may end. It is much more common for short term disability insurance benefits to continue, even if you lose your job, but you should be aware this may happen. Long term disability insurance benefits, however, will continue even if you lose your job. This makes sense because long term disability benefits are meant to cover extended periods of time in which you are unable to work, and seriously injured workers often cannot ever return to their old jobs.

Second, short term disability insurance benefit plans often will not apply if you were injured at work. Short term disability insurance plans have the right to deny coverage altogether if you are also making a workers compensation claim. In contrast, long term disability plans cannot do this. Rather, if you were injured at work and you cannot return to work for a longer period, you can receive both long term disability insurance and workers compensation. The long term disability benefits typically will be reduced by your workers compensation benefits, but it usually makes sense to pursue all applicable benefits, including Social Security Disability Insurance (SSDI) benefits, if possible.

Beyond this, special rules may apply to your short term disability insurance claim. This may impact your ability to recover benefits.

How Do I Know If I Am Covered By a Short Term or Long Term Disability Insurance Policy?

Short term and long term disability insurance comes from two sources – coverage you purchase for yourself and coverage provided through your employment. It is possible to have both individually purchased coverage and employer provided coverage. If you are unsure about whether you have purchased short term and long term disability insurance, your insurance agent should be able to advise you. If you are unsure if you have coverage through your employer, your human resources department will have this information. In either case, ask to review the “Plan Document,” which will provide you with the exact terms of your coverage.

My Employer Offers Short Term Disability Insurance But Not Long Term Disability Insurance.

Many employers offer short term disability insurance coverage to their employees. It is not required by law, but rather an optional employee benefit. You should review the terms of the plan to know what types of disabilities are covered and for how long. Each disability policy is different. Most short term disability plans offer benefits for between four to twenty-six weeks of disability. Obviously that is a big difference, so it is important to know the length of coverage. If your employer does not offer long term disability insurance, you can purchase your own coverage through an insurance agent. Before doing so, you should review your short term disability coverage with your agent to make sure there is not a gap between when your short term coverage ends and your long term coverage begins. Additionally, some short term disability insurance plans state you need to be employed in order to continue to receive short term disability benefits.

My Employer Offers Long Term Disability Insurance But Not Short Term Disability Insurance.

Some employers offer their employees long term disability insurance coverage, but not short term disability insurance coverage. Again, employers are not required to offer any coverage at all. If your employer offers long term disability insurance but not short term disability insurance, you can purchase your own policy through an insurance agent. Additionally, most disability policies provide replacement of a percentage of your pre-disability earnings. It is also possible to purchase a supplemental long term disability insurance policy that will make up the difference. For example, if your employer’s plan pays 60% of your wages if you become disabled, you can purchase a separate plan to pay the remaining 40% of your pre-disability wages.

Has Your Claim For Short Term or Long Term Disability Insurance Benefits Been Denied?

Even though you have purchased short term or long term disability insurance, it does not guarantee you will actual get the benefit in the event you need it. Unfortunately, thousands of injured and sick workers each year are illegally denied the disability benefits because insurance companies have incentive to deny benefits. When this happens, you have the right to appeal the denial and, if necessary, sue the insurance company for your benefits.

My practice focuses on helping people get their short and long term disability benefits. I have been fighting for disabled people for years and have secured benefits for my clients from all of the major long term disability insurance companies, including Unum, CIGNA, Hartford, MetLife, Sun Life, Lincoln Financial, Mutual of Omaha, Disability RMS, Reliant Standard, Northwestern Mutual Life, Madison National Life, and more.

If you have been denied disability insurance benefits and would like to discuss your rights, please contact me for a free consultation.

- How to Appeal a Long Term Disability Denial - June 6, 2023

- Liberty Mutual Long Term Disability Claims Now Managed By Lincoln Financial - May 31, 2019

- You Can Receive Worker’s Comp and LTDI Benefits Simultaneously - October 26, 2018